|

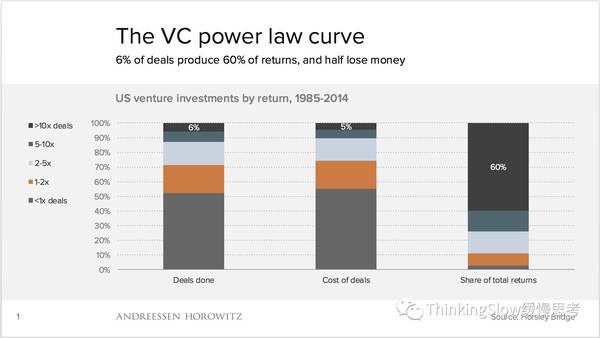

谢谢关注缓慢思考。我的好朋友常斌说每周日晚不看我更新睡不着,特发此文:-)。 原文来自美国A16Z基金的Benedict Evans的博客。文章分析了其LP投资的风险投资基金从1985年到2014年所投资的7000个公司的回报,总结了顶级VC(基金回报超过5倍)的成功之道:最好的VC基金,不只是有更多的失败和更多的大赢家 — 他们有更大更大的大赢家(10倍以上的投资平均回报64.3倍)。 In most jobs and most industries, if you do something that doesn't work out, that's a bad thing, and you might get fired. If you write a cover story for a newspaper that turns out to be untrue, you have a problem. If you ship a product that breaks, you have a problem. 对大多数工作和行业,如果你做的东西失败了,这肯定是件坏事,你可能会被解雇。如果你为报纸写的封面故事不真实,你会有麻烦。如果你交付的产品不工作,你会有麻烦。 If you do something that doesn't work out, that means you screwed up. 如果你做的事情失败了,那意味着你搞砸了。 Startups and startup investing don't quite work like this. 创业公司和创业投资不是这样。 Last year Horsley Bridge(one of our LPs - investors in a16z'sfunds) shared some aggregate data with us on just over 7,000 investments made by funds in which it invested, from 1985 to 2014. This gives a good way of visualising the world of VC-backed startups. First, the high level: 去年, Horsley Bridge(我们的LP之一 A16Z基金的投资人)和我们分享了一些汇总的数据,覆盖了它投资的基金从1985年到2014年所做的7000多个投资。这些数据形象的描绘了VC所支持的创业公司的世界。首先,概括来看: Around half of all investments returned less than the original investment 6% of deals produced at least a 10x return, and those made up 60% of total returns 大约一半的投资不能拿回本金 6%的投资产生了产生10倍以上的回报,并构成了总回报的60%

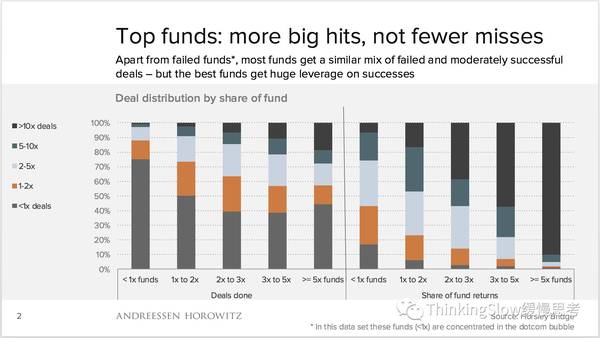

Digging into the data to look at the returns of different funds, below: 进一步挖掘数据,可以看到不同基金的回报表现: With the exception of funds that simply flamed out (concentrated in the dotcom bubble), everyone lost money on around half of their deals But the best-performing funds actually had more <1x deals - more deals that lost money in absolute terms. You could call this the 'Babe Ruth effect' - you take more risks to get the best returns A fund gets better returns by having more really big hits, not by having fewer failures 除了少数消失了的基金(集中在网络泡沫的年代),每家基金一半左右的投资都是赔钱的 但是,表现最好的基金拥有更多的<1X回报的投资 — 即绝对数量上讲拥有更多赔钱的投资。你可以称之为“Babe Ruth效应” — 你冒更多的风险,以获得最佳的回报 一家基金获得更好的回报,要通过拥有更多真正的高回报项目,而不是减少失败投资的数量

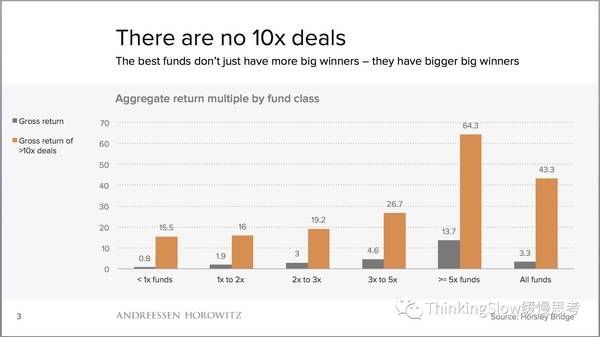

That concentration continues when you ask just what a '10x deal' really is - in fact, there’s no such thing. For funds with an overall return of 3-5x, which is what VC funds aim for, the overall return was 4.6x but the return of the deals that did better than 10x was actually 26.7x. For >5x funds, it was 64.3x. 这集中度会进一步展现出来,当你问什么是真正的“10倍回报”投资 — 事实上,没有所谓的“10倍回报”。对于那些总体回报达到3~5x的基金(这是风险投资基金的目标),atv,整体回报率为4.6倍,但这些基金中所谓“10倍回报”以上的投资的真实回报倍数是26.7倍。对于总体回报>5x的基金,这个数字是64.3x。 The best VC funds don’t just have more failures and more big wins - they have bigger big wins. 最好的VC基金,不只是有更多的失败和更多的大赢家 — 他们有更大更大的大赢家。

If you're a portfolio manager in a conventional public equities fund and you invest in a bunch of stocks that go down (or underperform the index), you could well lose your job, because your other investments can't make up for that loss. And if a public company went to zero, that would meant that a lot of people had screwed up really badly - public companies aren't ever supposed to go to zero, in the ordinary run of things. (责任编辑:本港台直播) |